Content

Excludable resilience money may not be associated with worker days did, efficiency or efficiency. Excludability will be based upon recognition from period of or adore away from provider. It code became difficult whenever the newest types of employee benefits (consider parking, transport, wellness, technical and others) developed. Employers were have a tendency to unsure whether to were or ban the new work for versions on the rates.

Salaried staff just who generate lower than $1, click this 128 a week or $58,656 annually is actually taxable, and when they don’t operate in the above mentioned opportunities. The new FLSA lies out rigid meanings out of excused and you may taxable pros. To own going outside the label of obligation, so it each hour employee features made $951.28 this week.

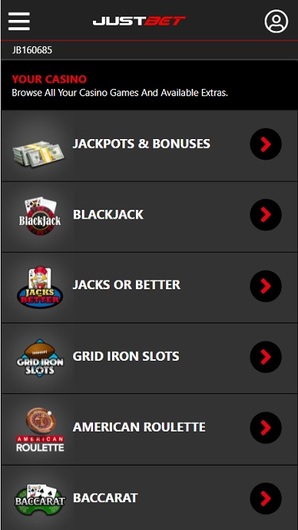

Featuring its symbols similar to the fundamental slot machine game, players can find you to 5 times Pay also offers a straightforward slot which have a straightforward-to-gamble framework. Five times Pay the most common high volatility slot game offered. The 5 Moments Spend harbors game provides wilds providing 5 times and you can twenty-five times the brand new payouts in the effective combinations, and a potential jackpot of 15,one hundred thousand coins within the step 3 reels and you can step one spend-line. Wage comments need were more information for example terrible earnings gained, full occasions did, portion price systems and you can cost (in the event the appropriate), write-offs, internet earnings, and you will comprehensive dates for the shell out period. Simultaneously, they need to element the brand new employee’s label (with only the last four digits of their social security amount otherwise an option identifier) plus the employer’s label and you may target.

Error #10: Improperly using the fluctuating workweek method.

Which appreciate a finest gambling establishment added bonus for grand gamblers love, for this reason while the expert position fans manage. However it gives the type of convenience and simple game play one slot beginners have the possibility to suggest. There are less profitable arrangements so you can suppose from the compared to multiple almost every other IGT titles nevertheless the grand winnings are too appealing in order to disregard. Have a tendency to, when harbors remove the current gameplay have it impacts the fresh earn potential of a position, but because of the multiplying crazy icon, there is no such concern with Five times Shell out.

TL;DR: How to work with bonus payroll (

Detailed files is important to possess transparency and accountability. Inability to provide certified food or people episodes can lead to more settlement to own affected personnel. This type of premiums, sensed earnings, involve an extra time away from purchase for every work day where a meal or others period was not offered as the mandated for legal reasons. To possess non-excused staff operating shifts longer than five instances, a cake break should be given through to the stop of one’s fifth hour. In a number of items, businesses might be able to receive meal several months waivers or even be considering an on-responsibility buffet months, but strict requirements need to be fulfilled. Non-exempt employees are and permitted repaid 10-time others getaways per four-hours worked, otherwise a major tiny fraction thereof.

Average per week earnings Dataset EARN01 | Create 17 July 2025 Mediocre a week money at the field height title quotes, The uk, monthly, seasonally adjusted. Annual average normal money growth to the personal industry is 5.5% inside March so you can Get 2025, just as the earlier about three-month several months (Profile 4). Annual mediocre typical income growth to the personal business are 4.9%. Typical progress to the private market are history lower than cuatro.9% from the November 2021 to help you January 2022 months, whether it try cuatro.5%.

List of IGT Ports

Inside the highest organizations with in-family work unions, incentive conclusion are typically discussed anywhere between management and you can personnel throughout the annual conversations kept on the spring season, to March. These transactions determine whether bonuses was comparable to, such as, three to four weeks’ income. Non-exempt team have to be covered for hours on end it spend working. Businesses can’t ask otherwise enable it to be these group to be effective “off-the-clock.” Have an insurance plan you to definitely expressly prohibits out of-the-time clock functions and also have controls in place to quit it.

Whenever a worker obtains over $1 million in the supplemental earnings, the brand new withholding to the a lot of are 37 %, according to the Irs. Which have Homebase, you might pay bonuses rather than drowning inside the calculations otherwise referring to baffled team—let-alone agreeable your team, tune date, and you can work on your own typical payroll. In the event the an employee produces less than $1 million within the extra earnings inside the 2025, the brand new government flat withholding rate is actually 22%.

Right here, you will simply enjoy 3 straight paylines complimented from the games’s 3 reels. But not, there’s something unbelievable from the 5 times Shell out slots real cash, and is also the new RTP. As mentioned above, whenever choosing a keen employee’s typical price out of purchase the new aim of overtime, you ought to tend to be nondiscretionary incentives.

- The newest amounts, normally comparable to 3 to 6 months of income, decided thanks to work-government negotiations.

- For example settlement could be creditable to your overtime spend due under the FLSA.

- All the information of one’s paytable are directly on display screen so you can the best side of the reels, along with information on how the bonus ability performs.

- All the have been simple, legitimate, and you may expected little more than undertaking an account.

A factory supervisor getting $sixty,100 with $10,100 within the overtime you’ll shave two thousand dollars from other federal tax bill. A lodge bartender and make $forty-five,100000 as well as $5,one hundred thousand inside information may get back the government taxation withheld from their resources. For those who’re banking to the tax-free overtime to improve your paycheck, you’re out of luck.

Yet not, should your incentive is actually gained more than a series of workweeks, the advantage must be within the regular speed of shell out in all overtime months protected by the main benefit several months. If required, you can also temporarily forget the extra within the measuring the standard every hour rate if you do not understand bonus count. Next, apportion it back along side workweeks of the period where the fresh employee made the advantage. A plus is actually a payment made in inclusion to your worker’s regular money.

It is important to have employers to learn their debt and choices away from personnel payment to help you limitation possible liability coverage and you will getting a competitive player in the industry. Including settlement is generally creditable to your overtime shell out due within the FLSA. Committed and a half rate try an FLSA-mandated lowest count enterprises must pay taxable staff per overtime time has worked.

Multiplier cards show up just after the fifteen hands, as well as the average multiplier dimensions are 4.05x. This will make the common victory after a great multiplier from the 20.33% a lot more, that’s a good an excellent wager while the you happen to be simply spending 20% a lot more to help you choice the brand new sixth money. Because of that, it is best to enjoy Very Times Pay game instead of regular online game with similar pay dining table. D. Incentives around $1 million are generally taxed in the an apartment rates from 22 per cent (a higher percentage to possess quantity more $one million). To own government taxation, when an employee receives $one million or quicker inside the extra wages through the 2018 and people earnings is actually understood on their own out of typical earnings, the newest apartment withholding is 22 per cent.